how to withdraw kiwisaver anz|hardship withdrawal from kiwisaver : 2024-10-06 KiwiSaver first home withdrawal. If you’ve been a member for at least three years, you may be able to make a first home withdrawal to put some of your KiwiSaver savings .

Aerie Oversized V-Neck Sweater. aerie. $19 $50. Size. XXS. Buy Now. Like and save for later. Add To Bundle. White oversized v-neck sweater from Aerie. Size XXS, but .

0 · withdrawing kiwisaver for first home

1 · lifestages kiwisaver withdrawal

2 · kiwisaver withdrawal online

3 · kiwibank kiwisaver hardship withdrawal

4 · hardship withdrawal from kiwisaver

5 · apply for kiwisaver withdrawal

6 · anz kiwisaver withdrawal hardship

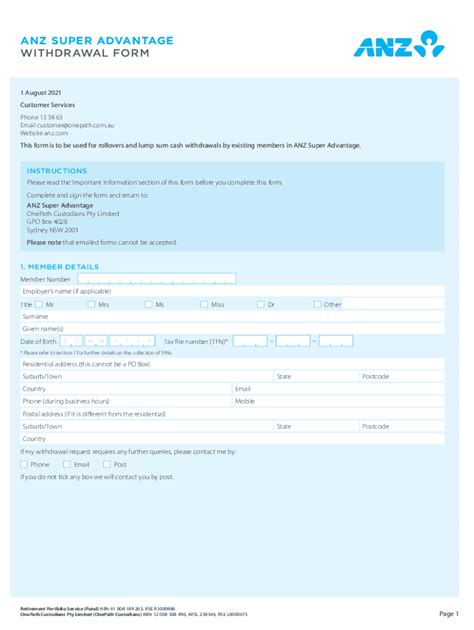

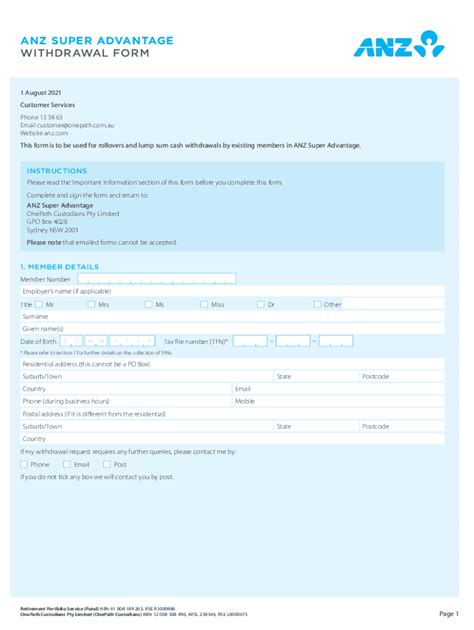

7 · anz kiwisaver withdrawal application form

Xe Historical Currency Exchange Rates Chart. Convert Send Charts Alerts. From. AED – Emirati Dirham. To. USD – US Dollar. We use midmarket rates. AED to USD Chart. Emirati Dirham to US Dollar. 1 AED = 0 USD. May 29, 2024, 23:52 UTC - May 29, 2024, 23:52 UTC. AED/USD close: 0 low: 0 high: 0. Popular US Dollar (USD) Pairings. .

how to withdraw kiwisaver anz*******Contact your scheme provider for the correct form to complete to make a hardship withdrawal. You only need to apply to us if you're within the first 2 months of your KiwiSaver membership. To withdraw savings you will need to provide evidence you .

You're eligible to withdraw all your KiwiSaver savings when you reach the .

How do I apply for an early withdrawal from KiwiSaver due to significant financial hardship? If you can provide evidence that you're suffering, or likely to suffer, .

The number of people withdrawing money from KiwiSaver for financial hardship reasons has almost doubled in a year. File photo. Photo: 123rf. Large numbers of New Zealanders continue to withdraw money .Withdrawing your KiwiSaver savings is straightforward - you generally become eligible to withdraw all your savings as a lump sum when you qualify for NZ Super (currently at the .KiwiSaver first home withdrawal. If you’ve been a member for at least three years, you may be able to make a first home withdrawal to put some of your KiwiSaver savings .To apply, please complete our Permanent Emigration Withdrawal Application Form (PDF 56kB). If you’re moving to Australia, you can transfer your KiwiSaver savings to an Australian complying superannuation fund that is willing to accept the transfer. See transfer your KiwiSaver savings to Australia.

• Information shown in your Investment Fund account in ANZ goMoney and ANZ Internet Banking is one business day behind the current date. As a result, the available balance might be different to the balance shown in ANZ GoMoney or ANZ Internet Banking at the time of submitting your request.how to withdraw kiwisaver anz hardship withdrawal from kiwisaver• Information shown in your Investment Fund account in ANZ goMoney and ANZ Internet Banking is one business day behind the current date. As a result, the available balance might be different to the balance shown in ANZ GoMoney or ANZ Internet Banking at the time of submitting your request.

If you move permanently to a country other than Australia, you can withdraw your funds after you’ve been overseas for at least one year. Please note that you can’t withdraw: any Australian sourced funds (e.g. if you’ve transferred money from an Australian super scheme to your KiwiSaver account), orhow to withdraw kiwisaver anzIf you move permanently to a country other than Australia, you can withdraw your funds after you’ve been overseas for at least one year. Please note that you can’t withdraw: any Australian sourced funds (e.g. if you’ve transferred money from an Australian super scheme to your KiwiSaver account), orYou won't be eligible for the Government contribution if you make a life-shortening congenital conditions withdrawal. Part-year eligibility. You can still get part of the Government contribution if during the year 1 July to 30 June you: Turned 18; . ANZ KiwiSaver Scheme: ANZ KiwiSaver Clearing Account 01-0102-0952766-01 ANZ .hardship withdrawal from kiwisaver[Text on screen: KiwiSaver first home withdrawal] Sam: It pays to review the fund you’re in every now and then. We have seven to choose from, so we’ll have one to match your circumstances. . ANZ New Zealand Investments Limited is the issuer and manager of the ANZ KiwiSaver Scheme. PDS available at anz.co.nz] Three great reasons to join .

There’s a misconception you need to withdraw your savings as soon as you turn 65 – but that’s not the case. You can leave your money in your KiwiSaver account until you decide to withdraw some or all of it. . ANZ New Zealand Investments Limited ('ANZ Investments') is the issuer and manager of the ANZ KiwiSaver Scheme and the ANZ Default .Each of the ANZ-managed KiwiSaver schemes have seven different funds, so you can choose how your savings are invested. It’s important to note the fund you’re invested in can make a big difference to the amount you have when you retire (or when you withdraw your savings to buy your first home).

When you reach the age that you're eligible to withdraw your funds, contact your KiwiSaver provider. Getting my KiwiSaver savings at 65. If you turn 65 you can still make contributions to your KiwiSaver account if you joined KiwiSaver before 1 July 2019 and you've been a member for less than 5 years (unless you choose to exit KiwiSaver when .At ANZ we make it easy to stay on top of your KiwiSaver account. Find out how to manage your account online, make and change your contributions, withdraw money, and transfer your Aussie super to your KiwiSaver account.KiwiSaver significant financial hardship withdrawal form - ANZ Bank New .Your KiwiSaver contributions are made after your income has been taxed, and the gains from your investments that you own in KiwiSaver are taxed as well. But when you withdraw for a first home or retirement at age 65, there is no tax to pay. It's your money to use. To withdraw your KiwiSaver money, contact your provider directly.You only need to apply to us if you're within the first 2 months of your KiwiSaver membership. To withdraw savings you will need to provide evidence you are suffering significant financial hardship. If your application is accepted you can only withdraw your and your employer’s contributions. Significant financial hardship includes when you:

Updated 13 September 2024 Important: This guide only relates to anyone reaching the age of 65.Our guides to Hardship Withdrawal Applications and First-Home Withdrawals have specific guidance. You can withdraw your savings: When you're eligible to withdraw your savings, apply to your KiwiSaver provider Any withdrawals from your KiwiSaver .

Your money is generally locked in until you’re 65 (you may be able to withdraw early, for example to buy your first home). ANZ KiwiSaver. ANZ Investment Funds. . For the ANZ KiwiSaver Scheme, ANZ Default KiwiSaver Scheme and ANZ Investment Funds, see Rates, fees and agreements;

Your KiwiSaver contributions are made after your income has been taxed, and the gains from your investments that you own in KiwiSaver are taxed as well. But when you withdraw for a first home or retirement at age 65, .You only need to apply to us if you're within the first 2 months of your KiwiSaver membership. To withdraw savings you will need to provide evidence you are suffering significant financial hardship. If your application is accepted you can only withdraw your and your employer’s contributions. Significant financial hardship includes when you:Updated 13 September 2024 Important: This guide only relates to anyone reaching the age of 65.Our guides to Hardship Withdrawal Applications and First-Home Withdrawals have specific guidance. You can withdraw your savings: When you're eligible to withdraw your savings, apply to your KiwiSaver provider Any withdrawals from your KiwiSaver .Your money is generally locked in until you’re 65 (you may be able to withdraw early, for example to buy your first home). ANZ KiwiSaver. ANZ Investment Funds. . For the ANZ KiwiSaver Scheme, ANZ Default KiwiSaver Scheme and ANZ Investment Funds, see Rates, fees and agreements;KiwiSaver first home withdrawal form - ANZ Bank New ZealandKiwiSaver subsequent retirement withdrawal form - ANZ Bank New Zealand

[Text on screen: KiwiSaver first home withdrawal] Sam: It pays to review the fund you’re in every now and then. We have seven to choose from, so we’ll have one to match your circumstances. . ANZ New Zealand Investments Limited is the issuer and manager of the ANZ KiwiSaver Scheme. PDS available at anz.co.nz] Three great reasons to join .See whether you could qualify to withdraw your KiwiSaver savings early, and how to apply. Change in circumstances. Early withdrawal could affect your long-term savings. Withdrawing some of your KiwiSaver savings now may be necessary, but if you can, it pays to leave as much in as possible. That way your savings have the best chance to grow for .This withdrawal option is only available to KiwiSaver members who suffer from certain congenital conditions. Please call us on 0800 ASB RETIRE ( 0800 272 738 ) to talk through your circumstances and the withdrawal process.However, you can also work out how much you can withdraw by using our Partial withdrawal for foreign superannuation tax liability calculation sheet - IR496. Your KiwiSaver savings when you die. Your KiwiSaver savings will become part of your estate when you die. Make sure the person looking after your will knows who your provider is.

ANZ SMART COICE SUPER WITHDRAWAL FORM. Page 5 8. TAX FILE NUMBER (TFN) NOTIFICATION Information you should know about providing your tax file number You or your employer may already have provided your Tax File Number (TFN) to the Fund, if not, we are required to tell you theKiwiSaver permanent emigration withdrawal form - ANZ Bank New Zealand

L'Aeroporto Internazionale di Malta (MLA) si trova tra le località di Gudja e Luqa, a circa 10 chilometri dalla capitale. È l'unico aeroporto del paese ed è conosciuto come Aeroporto di Luqa o Aeroporto di La Valletta. Più di 30 aerolinee transitano in questo aeroporto, che riceve circa sei milioni di passeggeri annuali.

how to withdraw kiwisaver anz|hardship withdrawal from kiwisaver